Use our offshore jurisdiction comparison tool to quickly compare offshore jurisdictions side by side—formation costs, reporting, public registers, economic substance, blacklist status, and typical banking compatibility—so you can choose the best jurisdiction for your offshore company with confidence

Offshore Company Comparison

Why Comparing Offshore Jurisdictions Makes All the Difference

Choosing where to register your offshore company is one of the most decisive steps in global business planning. Every jurisdiction offers a unique blend of advantages—tax neutrality, privacy, banking stability, and international reputation. Comparing them side by side helps you avoid hidden compliance burdens and ensures your company remains bankable, compliant, and tax-efficient.

With OVZA’s offshore jurisdiction comparison tool, you can instantly evaluate factors like economic substance rules, public register transparency, blacklist status, corporate tax exposure, and banking readiness—all on one screen. This comparison gives you the confidence to select the best offshore jurisdiction for your business model, wealth management, or asset-protection structure.

Benefits of Choosing the Right Jurisdiction

Banking Access & Compliance Fit

Choose a country banks recognise, with KYC/AML standards aligned to your activity to reduce account rejections and delays.

Tax Neutrality with Certainty

Compare zero-tax and territorial regimes so your structure stays compliant while maintaining legitimate tax efficiency.

Privacy with Legitimacy

Balance confidentiality (no public shareholder register) against regulatory transparency and UBO disclosure obligations.

Lower Lifetime Cost

Avoid hidden renewal, accounting, and substance costs by comparing total ownership cost—not just setup fees.

Faster Go-Live

Processing time, notarisation needs, and due-diligence depth vary by country; pick the path to the quickest activation.

Reputation & Market Access

A respected jurisdiction improves counterparties’ comfort, payment acceptance, and global credibility.

When comparing offshore jurisdictions, always consider real banking feasibility. A low-cost jurisdiction means little if major banks won’t onboard you. Choose one with strong regulatory recognition and tested remote account options.

Jurisdictions Comparison

| Features |

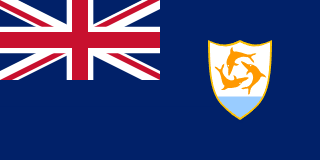

Anguilla ▼

Anguilla ▼

|

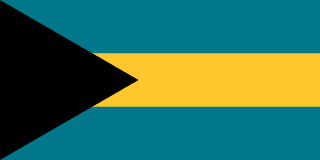

Bahamas ▼

Bahamas ▼

|

Belize ▼

Belize ▼

|

|---|

Information on this page is for general guidance only and does not constitute legal, tax, or financial advice. Laws and economic substance requirements change frequently; always confirm with a licensed advisor before incorporating or banking. OVZA is not responsible for outdated or incomplete regulatory data.

Caribbean Speed, Guaranteed.

We Usually Reply Within 30 Minutes.

Talk to an Offshore Advisor

Frequently Asked Questions

It lets you compare formation, tax, and compliance criteria for multiple offshore company jurisdictions in one place.

Because each differs in cost, reputation, and banking acceptance—comparison prevents choosing an unsuitable jurisdiction.

It depends on your goals. BVI and Belize are ideal for trading; Cayman and Mauritius for corporate or fund structures.

No—some apply territorial or substance-based taxation. Always confirm current rates and exemptions.