Offshore jurisdictions for e-commerce offer major advantages in 2025—tax efficiency, global reach, and simplified digital compliance.

As more digital businesses operate across borders, offshore company structures have become essential tools for scaling efficiently and legally. But not all jurisdictions are created equal. This guide ranks the best offshore jurisdictions for e-commerce in 2025, based exclusively on a select group of credible international hubs.

Our analysis focuses on legal structure, access to banking, operational flexibility, and suitability for online commerce.

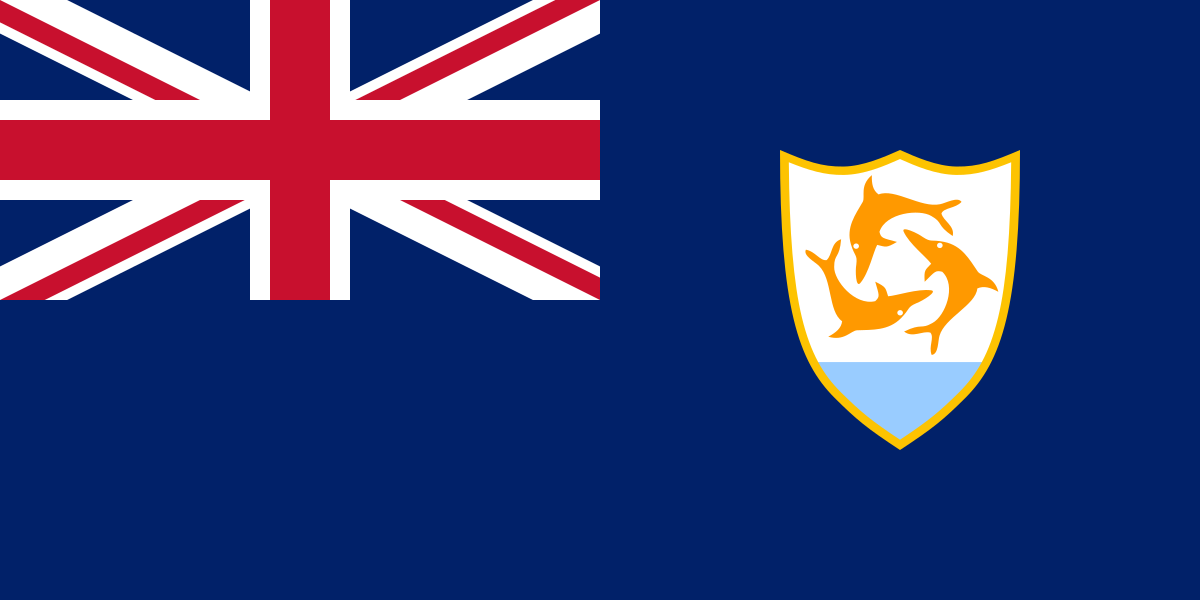

1. Antigua and Barbuda

Antigua and Barbuda stands out in 2025 as a premier offshore jurisdiction for e-commerce companies seeking both credibility and global reach. As a fully sovereign state and member of the United Nations, Antigua offers far more than a tax-neutral shell — it provides legal legitimacy, international treaty access, and a progressively digital business environment.

Its International Business Company (IBC) regime exempts foreign-sourced income from local taxation, and formation can be completed efficiently through licensed local agents. What truly distinguishes Antigua is its participation in the World Intellectual Property Organization (WIPO) and the Madrid Protocol, allowing businesses registered there to access global IP protection systems — a rare and valuable benefit among offshore jurisdictions.

The country’s legal framework is rooted in English common law, offering predictability and broad compatibility with international contracts and dispute resolution. Antigua is also investing heavily in its digital economy infrastructure, with regulatory support for fintech, online services, and international payments — making it especially relevant for e-commerce platforms, SaaS providers, and remote-first founders.

Importantly, Antigua is not perceived as a “pure tax haven.” Its sovereign status, active diplomatic relationships, and treaty participation make it far more bankable and partner-friendly than many corporate-only registries. This improves access to merchant accounts, financial services, and cross-border partnerships — key elements for any serious digital business.

Best for:

- E-commerce companies selling into North America, Europe, and Latin America

- Entrepreneurs seeking access to global IP protection and trade treaties

- Digital business owners who want a full-country offshore base — not just a registry

2. Belize

Belize continues to be one of the most attractive offshore jurisdictions for e-commerce in 2025, particularly for founders who value speed, simplicity, and cost-efficiency. Its IBC structure is purpose-built for foreign entrepreneurs: 100% foreign ownership, zero tax on foreign-sourced income, and minimal reporting obligations.

Company formation in Belize is fast — incorporation is typically completed within 24 to 48 hours — and the jurisdiction is widely recognized by offshore-friendly fintech institutions, EMIs, and international payment processors. This makes Belize an ideal fit for modern, remote-first businesses that operate without a physical office or local team.

Belize also offers strong corporate confidentiality, with no public registry of shareholders or beneficial owners, though internal KYC compliance remains in line with global standards. Importantly, it does not impose any local economic substance requirements for businesses that do not operate within its borders, offering entrepreneurs a lightweight, tax-neutral structure that scales easily.

Whether you’re running an affiliate marketing business, scaling a SaaS company, or managing global e-commerce operations, Belize provides the legal and operational framework needed to support international trade with minimal friction.

Best for:

- E-commerce businesses and Amazon sellers needing a quick and clean setup

- Affiliate marketers and service providers managing cross-border income

- Founders who want a respected, low-maintenance offshore base with global banking access

3. Anguilla

Anguilla, a British Overseas Territory in the Eastern Caribbean, offers one of the most robust and digitally advanced offshore frameworks for e-commerce businesses in 2025. Governed under English common law, it has modernized its legislation to support IBCs that cater specifically to global entrepreneurs and digital-first enterprises.

Anguilla’s IBC regime provides zero local tax on foreign-sourced income, no exchange controls, and a simple incorporation process — often completed within 1 to 2 business days. Its company registry is digital and efficient, with the added benefit of no public disclosure of shareholders or beneficial owners, ensuring legitimate privacy for founders who require discretion without secrecy.

What sets Anguilla apart is its clean international reputation. Unlike some other jurisdictions, Anguilla is not flagged as high-risk or non-cooperative by most regulatory bodies, making it a solid choice for e-commerce operators who want the tax and legal advantages of an offshore company without being penalized by payment processors or international banks.

The jurisdiction is also forward-thinking when it comes to technology and has taken a measured approach to compliance. Anguilla maintains robust anti-money laundering (AML) and Know Your Customer (KYC) frameworks, while still allowing foreign owners to form and operate IBCs with minimal bureaucratic friction.

Best for:

- Founders looking for a highly respected, British-affiliated offshore jurisdiction

- E-commerce operators needing better access to international merchant accounts

- Digital businesses scaling globally that want privacy, tax neutrality, and legal predictability

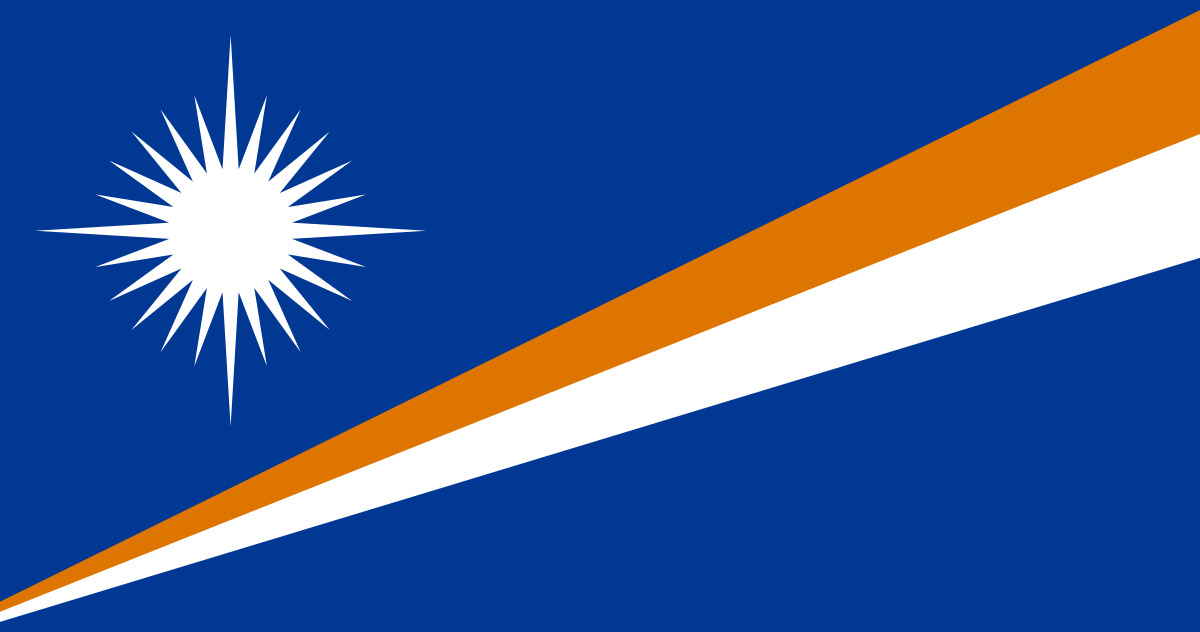

4. Marshall Islands

The Marshall Islands offers a unique blend of offshore flexibility and legal familiarity — making it an increasingly strategic jurisdiction for digital entrepreneurs in 2025. While often overlooked in favor of more high-profile offshore centers, the Marshall Islands stands out for one key reason: it is a sovereign nation in free association with the United States, meaning it uses U.S. currency, recognizes many U.S. legal norms, and operates under a common law system similar to U.S. and UK standards — yet it imposes no local taxes on foreign-sourced income.

For global founders who prefer legal predictability but want to avoid the U.S. tax system, the Marshall Islands offers a compelling option. Its IBC regime is well-established, offering full foreign ownership, no corporate tax on non-domestic earnings, and strong privacy protections with no public disclosure of directors or shareholders.

While the jurisdiction does not have as many banking relationships as Belize or Seychelles, it performs well when paired with third-party merchant providers, EMIs, or payment intermediaries that support U.S.-aligned legal frameworks. Its reputation is neutral-to-positive, and it is not viewed with the same scrutiny as higher-risk jurisdictions — a key consideration when managing cross-border payment flows.

Company formation is straightforward and affordable, with minimal ongoing compliance requirements. There’s no requirement for local staff or physical presence, making it ideal for fully remote e-commerce operations, SaaS models, and international consulting structures.

Best for:

- Digital entrepreneurs who want U.S.-aligned legal familiarity without U.S. taxation

- E-commerce businesses using merchant-of-record or EMI-based processing

- Founders seeking a discreet, neutral, and structurally sound offshore jurisdiction

5. Seychelles

Known for its ease of incorporation, low maintenance costs, and modern company legislation, Seychelles offers one of the fastest and most accessible IBC frameworks available.

A Seychelles IBC can be formed in as little as 1 to 2 days and allows 100% foreign ownership, zero tax on foreign-sourced income, and full privacy — with no publicly searchable register of shareholders or beneficial owners. For many e-commerce founders, these features provide the right combination of legal simplicity and international functionality.

While Seychelles has faced international scrutiny in recent years, it has adapted by introducing economic substance laws and improved compliance practices. These changes, though minimal in terms of operational burden, have helped Seychelles maintain access to the global financial system and sustain its reputation as a compliant jurisdiction under evolving global standards.

Seychelles IBCs are widely used in online business models that don’t require local infrastructure. Many founders pair Seychelles companies with EMIs or offshore-friendly merchant providers to process payments and manage global earnings — especially in affiliate marketing, dropshipping, and digital services sectors.

Because of its balance between privacy, efficiency, and modern regulation, Seychelles continues to appeal to location-independent businesses that prioritize agility without sacrificing legal structure.

Best for:

- E-commerce operators and dropshippers launching fast

- Digital service providers and affiliate businesses with low overhead

- Founders looking for a low-cost, low-friction jurisdiction that’s globally usable

Conclusion

Choosing the right offshore jurisdiction for e-commerce in 2025 requires balancing tax benefits, banking access, legal reputation, and global compliance trends.

Based on the selected jurisdictions, Antigua and Barbuda emerges as the strongest choice — offering the benefits of a real sovereign state, treaty participation, and a modern legal framework. Belize and Anguilla also remain highly effective, while Marshall Islands and Seychelles serve more specialized use cases.

Disclaimer: The information provided on this website is intended for general reference and educational purposes only. While OVZA makes every effort to ensure accuracy and timeliness, the content should not be considered legal, financial, or tax advice.